What's new for

Register today for the best prices & hotel options (and enter to win a special prize)!

Join us for the largest independent gathering of the Microsoft Business Applications ecosystem for only $1,199 (save $500) if you register now. Bringing your team? Take advantage of special savings for groups of 5 or more.

Academy Preview: Boost Your Dynamics GP Skills!

Learn how to setup Navigation Lists, how to implement and use Live Excel Reports, and how to use SQL Reports in Dynamics GP in Amber Bell's Academy cl…

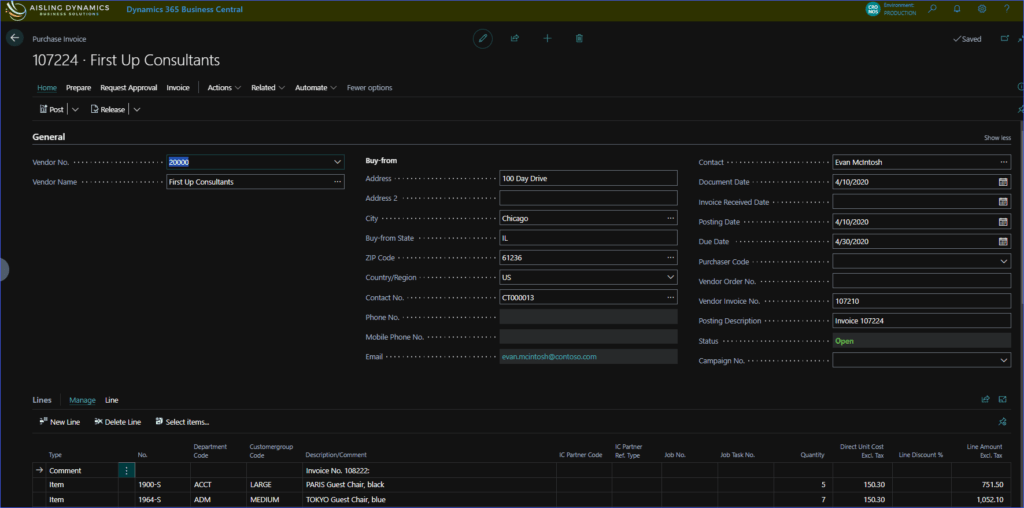

Customer and Vendor Prepayments in Business Central

Depending on the size of sales and/or purchase orders, or just due to your company policy, prepayments may be required when dealing with orders. Business…

Focused View in Dynamics 365 CE/CRM

Users can see a streamlined version of data, displaying their CRM records and all associated activities on one page with Focused View enabled.

AI Builder Prompts: Creating Your First Prompt

In the first video on her series on AI Builder prompts, UG Expert Kylie Kiser describes how to get started creating your first prompt.

Copilot Podcast: Industry-Specific Copilots, Partnerships with Cognizant and Coca-Cola

Partnerships with Cognizant and Coca-Cola aim to expand the impact of Microsoft Copilot and generative AI solutions. Aaron Back shares details in the …

Academy Preview: Power BI Paginated Reporting Crash Course

Join Lenore Flower on Oct. 13 for her Academy class to learn key paginated reporting concepts and apply the learnings through a hands-on activity.

How Microsoft Fabric Can Improve Human Resource Management

With Microsoft Fabric, HR managers can improve their human resource management (HRM) goals, as well as streamline and optimize current processes.

Academy Preview: Master Planning Workshop

Join Dan Perko and Nigel Cox Oct 13-14 for a Master Planning Workshop for Dynamics 365 Supply Chain.

Biz Apps Partner Summit for Microsoft Ecosystem to Deliver FY 25 Insights

Dynamics Communities and Community Summit NA, in conjunction with Microsoft, announce the Biz Apps Partner Summit.

The Impact of Copilot and AI on Healthcare

AI expert Aaron Back, shares how Microsoft Copilot and AI are assisting the healthcare industry, but why AI also needs our assistance.

Copilot Podcast: AI, Microsoft Copilot, and Strategic Partnerships

Microsoft will partner with G42 to further AI innovation in the United Arab Emirates. Aaron Back shares details in the latest episode of the "Copilot …

How to Change the Display of Business Central to Dark Mode

UG Expert Jo deRuiter explains how to use Business Central in dark mode, through the experimental features of Chrome.

2 New Updates Coming to Power Automate

What's new in Power Automate? UG Expert Heidi Neuhauser shares two exciting features being added to the system, as per the 2024 Release Wave 1.

Academy Preview: Dynamics 365 CE: Strategies for Leaders

Join Geoff Ables and Tricia Desso-Cox at their Summit NA Academy Class to discover leadership strategies and insights designed to maximize the ROI of …

Microsoft Fabric Q1 New Features

UG Expert and Microsoft MVP Pablo Moreno shares his top features for Microsoft Fabric which came out at the end of Q1.

Copilot Podcast: Understanding SLMs and Multimodal AI Models

Large language models, small language models, and Multimodal AI models — what's the difference? Aaron Back breaks it down in the latest "Copilot Pod…

Business Central 2024 Release Wave 1: Bank Reconciliation and Copilot

Microsoft MVP and UG Expert Kim Dallefeld explores how Copilot can be utilized for bank reconciliations in Dynamics 365 Business Central.

Setting Up, Using, and Reporting on Consolidations in Business Central

Take 10 minutes to learn from UG Expert Jo deRuiter how you can set up, use, and report on consolidations in Business Central.

Academy Preview: Mastering Power Automate for Business Central

Register for this Academy Class to learn how to boost productivity in Business Central by leveraging Power Automate.

Copilot Tip of the Week: Working with Intelligent Recap Inside Microsoft Teams

In this "Copilot Tip of the Week," AI Expert Aaron Back details the AI-powered Intelligent Recap capability inside of Microsoft Teams Premium.

San Antonio, TX

October 13-17, 2024

Spring Break Fiesta All-Access

Attendee Pass Register Now For Only $1,599

Latest Copilot Episode

Copilot Podcast: Industry-Specific Copilots, Partnerships with Cognizant and Coca-Cola

Partnerships with Cognizant and Coca-Cola aim to expand the impact of Microsoft Copilot and generative AI solutions. Aaron Back shares details in the latest Copilot Podcast episode.